Filing a Roof Damage Claim in Florida

Florida is no stranger to severe weather, and homeowners need to be prepared for the possibility of roof damage. If your home or business has suffered roof damage as a result of a hurricane, tropical storm, or another severe weather event, the first step is to contact your agent or insurer as soon as possible and request a copy of your policy. Once you have your policy in hand, review the details of your coverage. Before filing your claim, it is essential to see what type of damage is covered and what limits apply.Types of Roof Damage

Your insurance may or may not cover several types of damage that can occur to your roof, such as:- Weather damage: This is the most common type roof insurance claim in Florida and is typically caused by high winds associated with severe weather events such as hurricanes and tropical storms. Wind or weather damage can take many forms, including missing or damaged shingles, tiles, or other roofing materials; holes or punctures in the roof; and debris impact. Most policies cover wind damage, but there may be limits on the amount of coverage. For example, your policy may only cover wind damage resulting in a roof hole, or it may exclude damage caused by flying debris.

- Fires: Fires are another common type of roof damage, and they can be caused by lightning strikes, electrical problems, or even careless smoking. Most homeowners insurance policies will cover fire damage, but there may be limits on the amount of coverage.

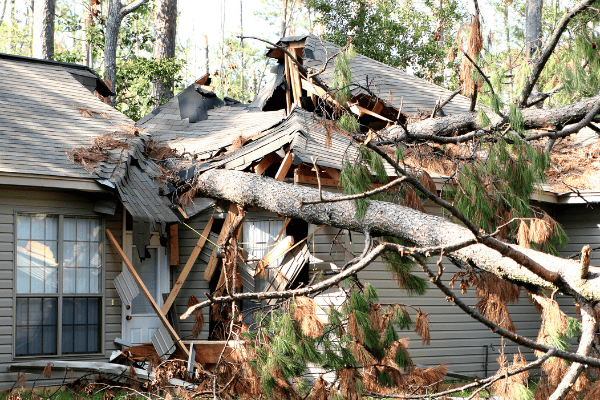

- Tree Damage: A tree falling on your roof can cause severe damage. However, not all policies cover this type of damage. Some policies will only cover the damage if the tree was knocked down by high winds, while others may exclude it entirely, especially if the damage was due to neglect.

- Vandalism: Although rare, your roof can also be vandalized. This type of damage is usually covered by homeowners insurance, but the amount of coverage may be limited.

Why Did My Roof Damage Claim Get Denied?

Unfortunately, insurance companies don't always play fair. There are many reasons why your insurance company may deny your roof damage claim, such as:- They claim your policy does not cover the damage.

- They say the damage was due to neglect and not caused by nature.

- They say the repairs will cost more than your policy limits.

What to Do If Your Roof Damage Claim Is Denied

If you believe that your insurance company wrongfully denied your claim, you have a few options:- You can appeal their decision.

- You can negotiate with the insurance company.

- You can file a complaint with your state's department of insurance.

- As a last resort, you can file a lawsuit.